How Will Brexit Impact Latin America?

Brexit is reshaping the UK's relationship with the rest of the world and it could present a huge opportunity for Latin America. LatAm INVESTOR investigates...

What Happened?

Britain shocked the world when it voted to leave the European Union. The referendum on the 23rd June resulted in a 52% to 48% vote in favour of leaving, sending out economic and political shockwaves globally. There has been no shortage of hyperbole in the wake of the decision. Ian Bremmer, founder of Eurasia Group, described it as “the most significant political risk the world has experienced since the Cuban Missile Crisis” whilst The Economist has said that it “risks becoming just the start of the unravelling of globalisation and the prosperity it has created.” The surprise result sparked leadership challenges in the two major parties, increasing political instability. Meanwhile sterling nosedived, while government bonds and the FTSE100 rose. Of course, until Britain triggers article 50 its membership of the EU remains the same. Moreover, there will be two years of negotiations before any action is taken. That makes it difficult to predict the exact fallout.

How will it impact Latin America?

Brexit does not pose an existential threat to Latin America. In fact, direct economic ties – those made up of trade and investment – between Latin America and the UK are marginal. Consequently, any absolute decline in the UK’s economic presence will only have minor direct consequences on Latin America. Latin American stockmarkets and currencies tumbled in the aftermath of Brexit but quickly recovered their value.

Any significant impact would come through the effects that Brexit has on Latin America’s most important economic partners: the EU, the United States, and China. If these economies are affected negatively by Brexit they will pass on their problems to Latin America.

"Latin American stockmarkets and currencies tumbled in the aftermath of Brexit but quickly recovered their value…"

First, there will be a delay in the negotiation of an EU-Mercosur free trade agreement. Whilst Britain and the EU debate the terms of Brexit, negotiations of trade deals with Latin America will be put on hold. Second, Brexit may trigger uncertainty in Europe, which could affect trade. If so this will disproportionately fall on those countries with full FTAs with the EU: Peru, Colombia and Central America. Third, global uncertainty will lead to an appreciation of the US dollar as investors seek safe havens away from the euro and pound. This will have effects on the prices of imports and exports between Latin America and the U.S., the costs of debt priced in U.S. dollars, and investment flows between Latin America and the U.S.

What about the UK’s trade with Latin America?

Bilateral trade between Latin America and the UK is minimal and therefore any reduction in trade will not have a large impact on Latin American economies. At present just 0.65% of the region’s exports go to the UK, although some countries are more exposed. For example, Colombia is the largest exporter of goods to the UK in the region with 2.5% of its total exports, while Brazil sends 1.7% of its exports to Britain. But Mexico, however, sends just 0.65%. A more serious trading consequence would be the knock-on effects of reduced trade with the EU, which is the region’s second-largest trading partner. Trade with the EU accounts for around 15% of Argentina’s trade, 20% of Brazil’s and 18% of Colombia’s, so it is clear that a Europe-wide slowdown would be far more significant than a slowdown confined to the UK. Over the last decade Britain’s trade with Latin America has been growing much faster than its trade with the EU, albeit from a tiny base. That trend is likely to be accelerated by Brexit as UK firms look to new, global opportunities. Indeed escaping some of the EU’s restrictions could make it easier to import Latin American goods.

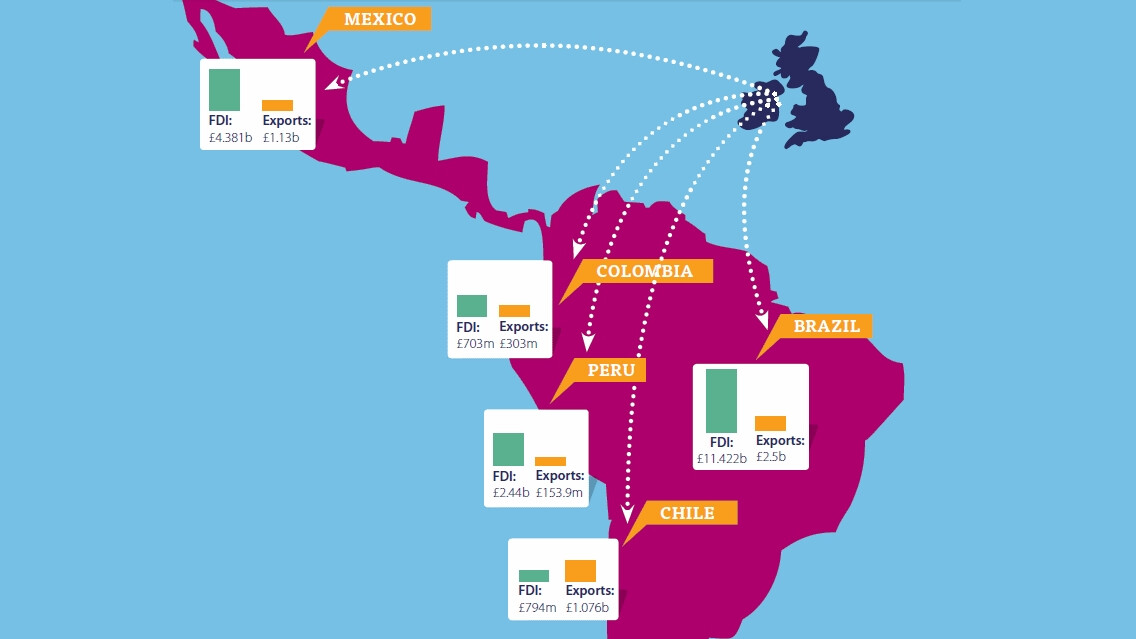

And the UK’s investment relationship with Latin America?

Investment from the UK is more substantial than trade, but still limited to a small number of countries. The UK is the second-largest source of FDI to Colombia and was the largest for Peru in 2014 with 18% of the total, with most British projects in the mining sector. In the short-term we can expect to see a slowdown in British investment in the region as the sharp depreciation of sterling reduces the capacity of British companies to expand abroad. However, in the medium to long-term the renegotiation of the UK’s relationship with Europe may encourage UK plc to look for opportunities in Latin America. Moreover, much of the UK investment in Latin America is directed through the financial hub of the City of London. If the City retains its prominent position in the global financial system then it seems likely to keep directing investment – especially for natural resource projects – to Latin America.

How can Brexit benefit UK companies in Latin America?

Britain’s exit from the EU leaves it available, and willing, to negotiate trade deals elsewhere. If trade deals between Britain and Latin American nations materialise, then we could see a boost in trade. Since 2010 the Government has pushed the ‘Canning Agenda’ to increase levels of trade and investment with Latin America – now Brexit has given it a sense of urgency. There have been reports of Britain seeking a trade agreement with Brazil, Mexico and Argentina. The depreciation of the pound should also give a boost to exporters. Among the wailing and gnashing of teeth about sterling among sections of the press it is easy to forget that much of the world is engaged in ‘currency wars’ and actively seeking a devalued currency. Latin American currencies have fallen heavily against the pound in the last few years, so the Brexit drop in sterling helps to restore some competitiveness.

How has it changed Latin American perspectives of the UK?

Latin America is fond of integration, with around 10 different regional blocs and talking shops. Much of this integration has been inspired by that of the EU. The news of Britain’s withdrawal the EU will be a blow to those who are seeking greater regional integration in Latin America, and could also potentially damage perspectives of Britain itself, which may be viewed as isolationist. Indeed Brexit has been portrayed negatively by the Latin American press. Post-Brexit Britain will have to work to show that it wants to interact with the region.

Does it change things for Latin Americans living in the UK?

It is too early to tell but if there is any change it will only be for those Latin Americans that are working in the UK under an EU passport. Many Latin Americans, particularly in the Southern Cone, have been able to obtain European passports through family ties. There has also been an increase in Latin Americans with European citizenship that have come from Spain has that country’s economy has struggled. Ownership of an EU passport will no longer guarantee free access to the UK labour market (unless it is a British passport). However, much remains to be confirmed about the future of EU citizens working in the UK.