Cuba Will Reward Investors

Cuba and the US are normalising relations and this historic shift will open up an exciting new play for LatAm-focused investors. We look at what is driving the story...

Sometimes when you invest in a stock, you worry if external forces are going to blow an otherwise good company off course. History’s full of dramatic examples: the Russian oil industry, before it got nationalised by the Soviet Union; or expensive ocean liners, built just before the advent of commercial air travel.

But, very rarely, sometimes it feels as though history is on your side. As if an irrevocable tide of events is pushing your stock upwards. And that is what is happening with Cuba.

Coming in from the cold

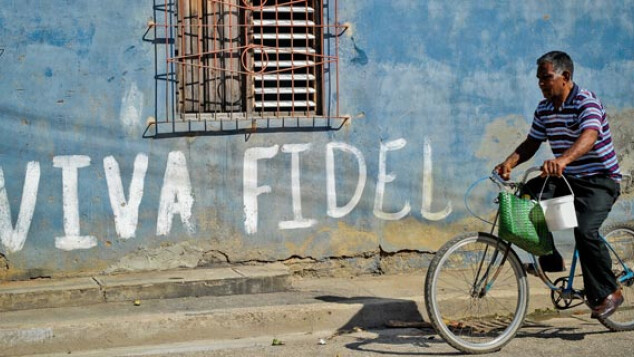

Firstly a quick recap. Last December, US president Barack Obama and his Cuban counterpart, Raul Castro, shocked the world when they announced a move to normalise relations between the two countries. Effectively, it means that Cuba is opening up to American companies.

Right from the beginning, this story has been more about excitement and future potential than cold hard facts. If you look at the simple facts, then Cuba’s tiny $68bn economy barely registers among the range of options available to US firms. But the country is hugely symbolic. Its plucky defiance against its huge neighbour made it a constant thorn in the side for America. So the rapprochement carries a lot of symbolism for both parties.

The island also holds a lot of potential. Sixty years or so ago, before Fidel Castro’s revolution, Cuba received more US foreign direct investment ($320m) than the rest of Latin America combined. It’s unlikely to regain that position, but it still has a lot to offer US firms.

Cuba’s location and climate make it attractive to the huge American tourist market. That’s why we’ve seen American airlines, hotel groups and even short-term house rent specialist, Airbnb, already signal their interest.

Cuba’s creaking agriculture system, transport infrastructure and telecoms network also offer big opportunities for international investors. Cuba may not be a big country, the population is under 12 million, but because nearly all of the economy is under state control at the moment, that means there is a lot that could be opened up to US firms.

History is on our side

But, like I said before, if you just look at the numbers Cuba, while promising, is still not a huge deal. The real reason I like investing in this story is because I think history is on our side. The embargo was a historical anomaly. In the long run, in a globalised world, it makes sense for two nearby economies to be fairly integrated. Especially when one of those countries is one of the biggest economies in the world. So the current situation, where the US is not present at all, is clearly not going to last forever.

And now moves have started towards rapprochement, it’s hard to see them being stopped. Sure, there are critics in the US. Some Republicans are against the move, saying that they worry about Cuba’s human rights record. One recently described Cuba as a “thuggish regime”. This is quite a statement when you consider that America’s foreign policy over the last 15 years has led to the death of hundreds of thousands of people, while Cuba’s biggest foreign intervention was helping to contain Ebola in West Africa. But ultimately these critics are fighting a losing battle. They may manage to delay or inconvenience the process but they can’t stand in the way of history.