A Brave New World - Coronavirus and Latin American Capital Markets

The region has seen record-high portfolio outflows, falling commodity prices and the sudden stop of external financing and economic activity. Boutique investment bank, BancTrust & Co. analyses Covid-19’s impact for investors in the region…

Boutique investment bank, BancTrust, analyses Covid-19's impact on Latin American markets. Find out more at www.banctrust.co.uk or contact its research and strategy team on [email protected]...

LatAm economies, as well as emerging and frontier markets (EM & FM) have been severely hit by the global financial conditions on many fronts. The combination of record-high portfolio outflows, the plunge of commodity prices, the sudden stop of external financing and of economic activity has taken a toll on already weak macroeconomic conditions. Surviving the economic effects of this crisis will require significant efforts in terms of correcting macroeconomic imbalances that could translate into sharp FX depreciations, reductions on overall consumption and even debt restructurings. A sluggish global recovery in the aftermath of the pandemic could lead to a permanent and sizeable decline in capital inflows targeting LatAm and shrinking domestic capital markets.

EM and LatAm countries are the most vulnerable

The spread of the COVID-19 and the decline of oil and other commodity prices is an unprecedented combination of external shocks that has increased the prospects of global recession and led to a spike in global risk aversion almost overnight. In just a few months, the global expectations and assets prices have worsened severely, affecting in a greater extent EM & FM. In fact, from January to April this year, the IMF global growth expectations fell by 3 percentage points (pp) to -3%, but for LatAm countries the correction was of 6.8pp to -5.2%. The same pattern can be seen in the currencies and stock indices of most countries.

The reasons behind the underperformance of these countries is clear: EM countries are less prepared to face the global crisis due to a higher dependence on external savings and on commodities exports and their lower policy response capacity. In turn, vulnerabilities translate into a sharp reversal of portfolio flows and currency depreciations that put upward pressure on inflation, while threatening financial stability. This has been the case in the last months, during which non-resident portfolio outflows from emerging markets reached a record of more than $100billion in the first quarter of 2020, the highest ever relative to their aggregate GDP.

"EM countries are less prepared to face the global crisis due to a higher dependence on external savings and on commodities exports and their lower policy response capacity…"

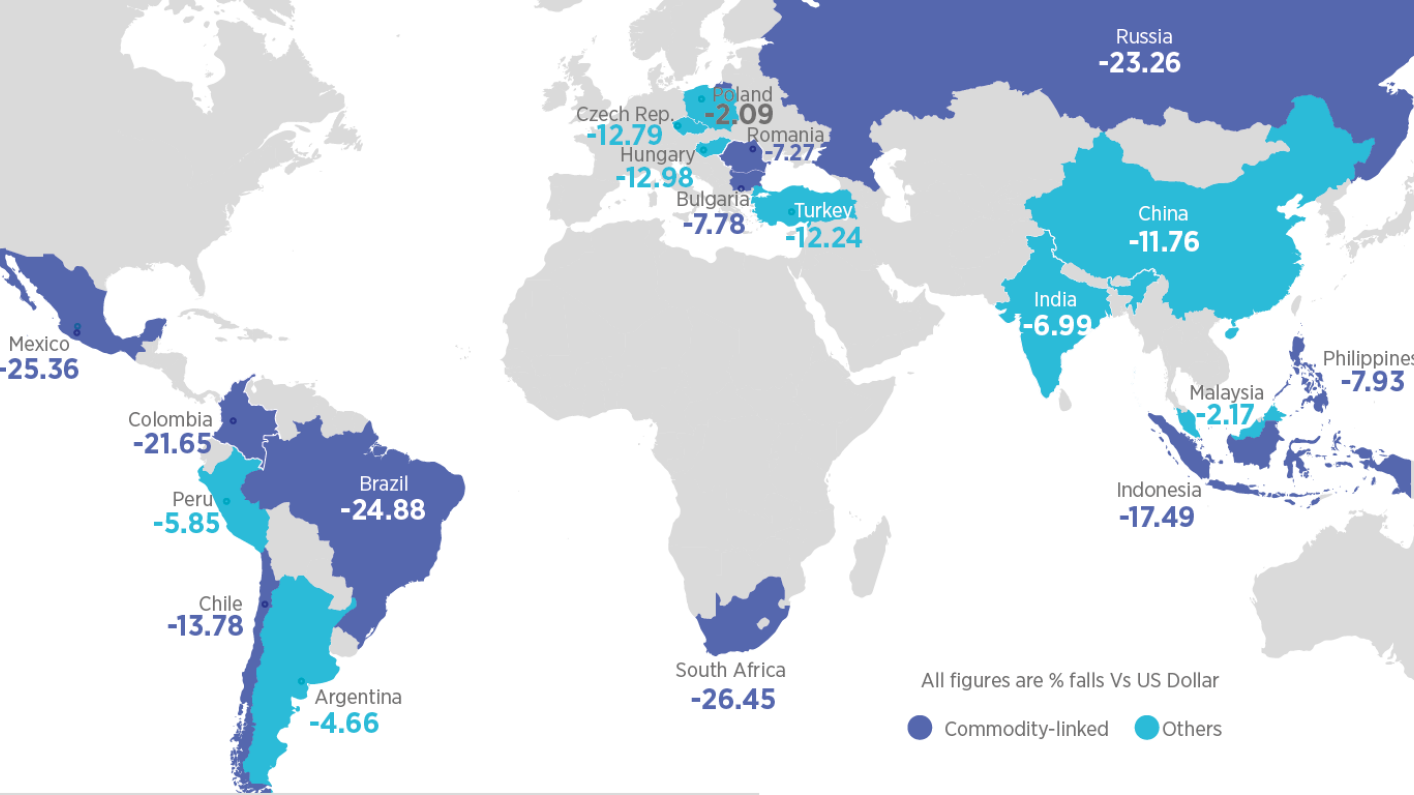

The countries in greater need of financial assistance due to its limited fiscal space, high financing needs, or external financing vulnerabilities, have been the ones where the sudden stop of capital inflows has been more severe. While commodity-producing economies, such as Brazil, Colombia, Mexico, Russia, and South Africa, saw their currencies tumble by more than 20% in the first quarter of 2020, countries with lower external vulnerabilities or more prone to implement currency interventions or capital controls have been relatively less affected (see Chart 1). Similarly, the risk premiums on US dollar-denominated bonds have posted a steeper increase in those countries with a lower credit rating (Chart 2).

What has been done so far?

To counter and mitigate the damage to their economies from the unprecedented the stoppage of economic activity and capital flow reversals, local authorities have announced contingency measures, mainly in the form of increases in fiscal spending and easing of monetary conditions. Many countries with low fiscal space, have requested funding to international financial institutions, such as the IMF and World Bank, and opened credit lines with central banks of developed countries. These funds have a twofold function of supporting higher public spending and at the same time containing FX pressures. Central banks are relaxing their monetary policy and encouraging lending to SMEs, at risk of fueling FX volatility. To avoid the latter, some central banks have implemented currency interventions, like Brazil, Mexico and Russia, while others have opted for capital controls as they hold a more limited intervention firepower.

What to expect ahead?

The strategy implemented by EM countries is broadly aligned with the recommendations given by international institutions such as the IMF and World Bank. Besides the humanitarian aspect, the main goal is to preserve the production capacity (i.e. potential output) and fending off massive bankruptcies to enable a faster rebound in the post-crisis.

However, the effectiveness of this approach will be conditioned by the duration of the crisis and to the speed of the recovery in the developed world, still subject to much debate all around the globe. A permanent impact on global growth will undoubtedly force adjustments on fiscal and external accounts. Solvency will be affected which will preclude a reduction in borrowing costs thus impacting negatively on financial intermediation.