Inflation and rising interest rates hit Latin America

Inflation and rising interest rates are set to dampen the region's economic recovery, writes Pollyanna De Lima, Economics Associate Director Economic Indices, S&P Global...

Overview

In line with the global picture, the economic outlook for Latin America has weakened since the last issue as prevailing headwinds were exacerbated by the Russia-Ukraine war. Rising interest rates, acute price pressures, income squeezes, turbulence in capital flows and COVID-19 loom large as key risks to growth.

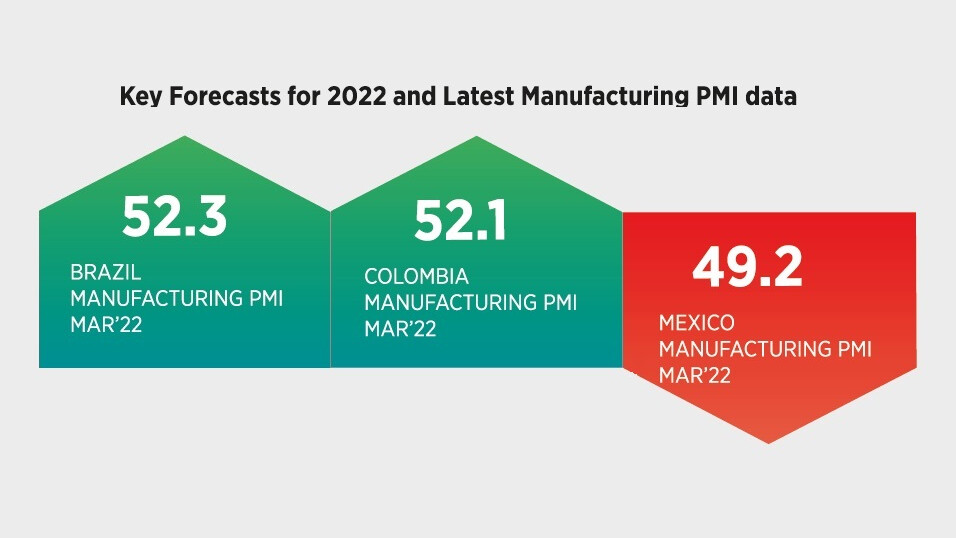

Official statistics data showed that output returned to pre-pandemic levels in Brazil and Colombia, but Mexico is yet to post a full recovery. Timely PMI (Purchasing Managers’ Index) data indicated that Brazil’s manufacturing sector recovered in March from the pandemic- related downturns seen around the turn of the year, with growth gathering pace in Colombia. Economic conditions remained challenging in Mexico, however, as goods production fell at a faster pace at the end of the first quarter.

In January’s update of the World Economic Outlook, the IMF downgraded the 2022 GDP forecasts for Brazil (from +1.5% to +0.3%) and Mexico (from +4.0% to +2.8%), owing to the new wave of COVID-19, the reintroduction of restrictions, energy price volatility and lingering problems in supply chains. Further downward revisions are expected in the April update as the impacts of Russia’s invasion of Ukraine are accounted for alongside strong monetary policy tightening in response to mounting inflationary pressures and their bearing on consumption and investment.

Brazil

Brazil came out of a technical recession in the last quarter of 2021, with GDP expanding 0.5% from Q3. The official data confirmed earlier results from PMI surveys of a sectoral divergence, as growth in its dominant service sector compared with a downturn in manufacturing.

While March PMI data highlighted a return to growth of manufacturing production, services continued to lead the recovery. Services firms reported the sharpest expansions in both new work intakes and business activity in close to 15 years, with hiring activity at its best since July 2007. Goods producers meanwhile signalled the first upturn in production for six months, though one that was modest overall. Factory orders rose moderately and there was a mild recovery in employment.

One area where manufacturers led was with regards to inflation, with stronger increases in both input costs and output charges. This was despite service providers recording a near-record upturn in input costs and an unprecedented rise in output charges.

To fight soaring inflation, Brazil’s central bank raised interest rates by a further 100 basis points in March. At 11.75%, the SELIC reached its highest in five years and presents an additional hurdle to private consumption and business investment. Indeed, price pressures, geopolitical tensions and supply-chain constraints dampened business confidence towards growth prospects, according to the PMI data.

Amid a subdued global economic outlook, the IMF lowered Brazil’s GDP forecasts for 2022 and 2023 to 0.3% and 1.6% respectively. High inflation looks set to persist, which on top of soaring energy prices, monetary policy tightening, capital flow risks and currency volatility limits growth prospects.

Colombia

Economic growth was sustained in Colombia in Q4 2021, with GDP expanding 4.3% on a quarterly basis. PMI data pointed to some weakness around the turn of the year, due to the fast spread of the Omicron variant, input shortages and staff absences, but growth gained momentum in March.

Firms signalled the fastest increase in factory orders in the year-to-date, which helped push output growth to a four-month high. Yet, rates of expansion were modest in both cases, with PMI panellists indicating that a lack of raw material availability, staff shortages and price pressures curbed the upturn. In fact, the latest results showed a record rise in outstanding business. That said, companies continued to address shortages by taking on extra staff and purchasing additional inputs for use in the production process.

Rates of both input cost and output charge inflation receded to one-year lows in March, though remained elevated by historical standards. Survey respondents blamed price pressures on raw material scarcity, limited freight availability and Russia’s war against Ukraine.

The central bank responded to inflationary pressures by hiking its benchmark rate to 5% in April, its highest since late-2017.

Looking ahead, goods producers forecast output growth but revised down their expectations amid rising concerns around acute price pressures, the presidential elections and difficulties sourcing key raw materials.

Mexico

Mexico is the only major Latin American nation where output has not recovered to pre-pandemic levels. GDP was flat in Q4 2021, following a reduction in Q3. The PMI was stuck in contraction during March, with companies reporting broad-based declines in new orders, exports, production, stocks and employment.

In addition to supply-side problems, firms continued to signal demand weakness. Troubles in the automotive sector, market uncertainty and the inability to fulfil contract obligations due to input shortages all hindered sales. Mounting price pressures remains a key issue to manufacturers, with input costs rising at the second-fastest rate on record in March. As a result, output charge inflation was at its highest since August 2018 as additional cost burdens were transferred to consumers.

Mexico’s policy rate was raised to a two-year high of 6.5% in March amid surging prices. At 7.3% in February, consumer price inflation was one of the highest seen in 21 years.

The IMF downgraded the 2022 GDP forecast to 2.8% in January, whilst upgrading 2023 to 2.7%. Key risks to the outlook surround inflation, restrictive monetary policy and their detrimental impact on real wages, consumption and investment.