Global economic slowdown set to dampen growth in Latin America

Pollyanna De Lima, Economics Associate Director, Economic Indicators & Surveys, S&P Global Market Intelligence, crunches the latest manufacturing data to analyse the region's growth prospects...

Overview

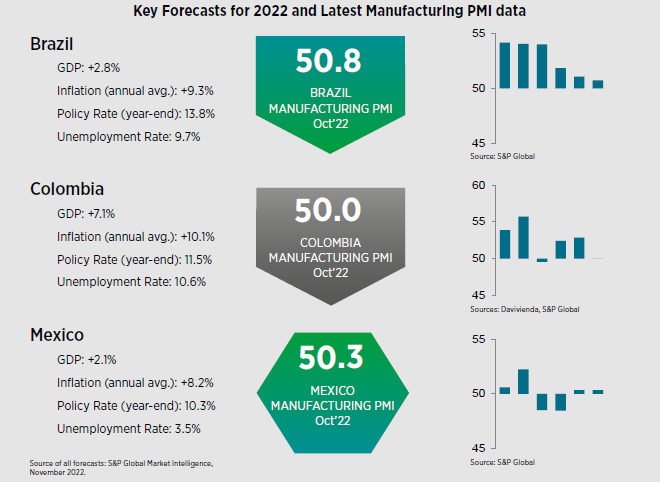

As signalled by the S&P Global PMI data, official statistics confirmed that second-quarter economic growth in Latin America was better than anticipated by the market, leading to upward revisions to full-year GDP forecasts. Heading towards the end of 2022, the PMI figures indicated a considerable loss of momentum across the manufacturing economies of Brazil, Colombia and Mexico in the third quarter and a mixed picture was painted for October. Stagnation in Colombia compared with marginal growth in Mexico and a moderate expansion in Brazil.

For 2023, risks remain skewed to the downside, with domestic and external challenges expected to dampen economic performances. Drawbacks range from the war in Ukraine, which is driving the energy crisis in Europe and pushing up global food prices, to the possibility of recessions in key markets such as China and the US dampening exports and tourism.

Meanwhile, central banks will likely lift or maintain interest rates in the near-term to tame inflation, while policymakers face the difficulty of avoiding endangering such efforts whilst addressing the cost-of-living crisis. Besides, exchange rates are expected to remain under pressure from capital flow volatility as investors turn to the US for attractive returns and a safe haven.

With macroeconomic data surprising on the upside, our 2022 GDP forecasts for Brazil, Colombia and Mexico were upgraded to +2.8%, +7.1% and +2.1% correspondingly. All of these three nations are expected to record notable slowdowns in growth during 2023, with our predictions at +1.3%, +0.9% and +0.7% respectively.

Brazil

Sales of Brazilian goods took a turn for the worse in October, according to our PMI data, contracting for the first time in eight months amid weaker domestic and international demand. That said, despite political uncertainty and concerns surrounding squeezed household finances, manufacturers were confident towards the outlook.

Buoyant optimism continued to support growth of jobs and production at the start of the fourth quarter. Providing some respite to goods producers, input costs fell for the first time in eight years owing to reduced commodity prices and lower tax measures. Cost savings were passed on to consumers via cuts to selling charges

In services, Brazil’s dominant sector, the PMI figures indicated that new business and output expanded at solid rates that were the strongest since July. Resilient demand conditions here meant that both input costs and output charges continued to rise sharply.

The official inflation rate for the monetary policy target has moderated substantially throughout the second half of the year so far, to the lowest in over a year-and-a-half. At +6.5% in October, although above the central bank’s upper limit of +5%, inflation was almost half of the peak seen in April.

The SELIC was unmoved at 13.75% in October, as the central bank kept the tightening cycle paused to assess the accumulated impacts of previously-undertaken hikes. We forecast cuts to the policy rate in 2023, which is anticipated to end the year at 9.8%, in line with predictions of inflation slipping to an annual average of +4.5%.

Lastly on Brazil, October’s S&P Global Business Outlook data showed strong hiring and investment (capex and R&D) intentions among private sector firms for the year ahead, against a worldwide trend of waning sentiment. Still, demand weakness, high interest rates, competitive pressures, inflation and political uncertainty were cited as key threats to growth prospects.

Colombia

For the first time in three months, Colombian goods producers signalled lower sales and output volumes in October. According to PMI survey participants, demand was dampened by challenging economic conditions and inflationary pressures. Businesses responded to these headwinds by reducing input purchasing to the greatest extent since mid-2021 and leaving workforce numbers broadly unchanged from September. S&P Global forecast the unemployment rate to settle at 10.6% in 2022, then fall to 9.4% in 2023.

PMI price indices indicated that inflation rates remained elevated in October. Due to stubborn price pressures, the central bank lifted the interest rate to 11.0% in its most recent meeting, the highest in over 21 years. We foresee one more increase this year (to 11.5%) and cuts from the third quarter of 2023.

With regards to economic growth, S&P Global forecast Colombian real GDP to expand +7.1% in 2022. An increase of only +0.9% is predicted for 2023 due to base effects, a global slowdown, inflation, high interest rates and their negative impact on demand.

Mexico

Mexico’s GDP is yet to recover to pre-pandemic levels, and the PMI data continued to point to weakness in the manufacturing industry. October saw further, albeit softer, contractions in new business and production but there were back-to-back increases in employment. As for inflation, the survey showed a sharper upturn in input costs parallel to a slower rise in selling prices. Firms’ attempts to boost sales continued to restrict pricing power.

Amid persistent inflation, the central bank hiked the interest rate to 10.0% in November, its highest on record. We expect inflation and subsequently interest rates to retreat in the second half of 2023, the former averaging +6.1% and the latter ending the year at 8.5%. Our GDP forecast for 2022 was upgraded to +2.1%, while we anticipate growth of just +0.7% in 2023. The slowdown for next year stems from a predicted recession in the US, which should negatively impact Mexican exports, tourism and foreign direct investment.

Manufacturers in the PMI panel foresee growth in 2023, but sentiment slipped in October due to growing concerns about a lack of money in circulation, acute price pressures, insolvency and automotive sector uncertainty