Five key lessons from the first months of Lula 3.0

Adam Patterson sees fiscal stress, economic warning signs and déjà vu in Brazil...

Economic policy

Brazil’s new president, Luiz Inácio Lula da Silva, took control of Latin America’s largest economy for the third time in January 2023. ‘Lula’ inherited a stable economy. Headline inflation, at 5.79% was way lower than the EU average of 9.2%. Brazilian unemployment was at its lowest since 2014 and GDP growing at 3.6% in the third quarter of 2022 - higher than both the US and China. If a week is a long time in politics a month can seem like an age in economics. Since Lula’s victory, the macroeconomic scenario has worsened. The expectation this year is modest growth of around 1%. Inflation is again starting to tick upwards. The country lost 430,000 jobs in December. M&A activity, which was running at record levels, peaked in June of last year. 2023 has started with a flood of company closures. The IMF recently stated that Brazil will have one of the lowest growth rates amongst emerging economies this year.

Of course, the challenging international economic picture is playing a part, but the initial “Lula effect” cannot be discounted. Indeed, the new government is already going through a “credibility crisis” according to the Correio Braziliense newspaper. Lula’s transition team helped sponsor a constitutional amendment through congress authorising an additional R$200billion in spending, busting the teto fiscal - the constitutional limits for government expenditure - which Lula has called “nonsense”. Tax rises to fund new social spending priorities are expected at R$150billion, including for the first-time millions of low-income Brazilians. This surely isn’t what Lula mean on the campaign trail when we promised to “put the poor in the budget”. Large corporates are also seeing tax hikes.

Lula's criticisms of the central bank – for maintaining rates - have had the reverse effect: raising inflation expectations and putting pressure on interest futures

Lula has attacked the independence of Brazil’s central bank and the monetary policy which experts have widely credited with keeping inflation under control. The market sees the central bank as an important break on out-of-control spending. The fiscal deficit is forecast to invert from a positive 1.45% to a negative 1.35% this year, according to estimates from Brazilian bank Bradesco. Lula's criticisms of the central bank – for maintaining rates - have had the reverse effect: raising inflation expectations and putting pressure on interest futures. It´s necessary to separate the more political speeches – aimed at a far-left base – from actual economic policy but initial market reaction has been broadly negative.

Macroeconomic reforms

It is a truism that Brazil requires extensive macroeconomic reforms, especially around tax, privatisations and pensions. Progress has been made over the last few years, especially with the 2017 labour reform in the Temer presidency (2016-2018) and the pension reforms of the Bolsonaro government, which have already generated public savings of more than R$156billion. And yet the initial signs are that broader reforms will not be a priority for the new government. New Pension Minister Carlos Lupi said he “did not believe in the Social Security deficit” and criticised previous reforms. These comments have since been partly walked-back. The fact is that even with the social security reform approved in 2019, last year´s federal budget already projected a R$363billion shortfall in long-term social-security accounts. Fiscal responsibility is fundamental. Even so, Lula has floated increasing Social Security benefits.

Moreover, as expected, the Government has put a sudden stop in eight ongoing privatisations from the Bolsonaro era, such as Petrobras, the Brazilian national mail carrier and the state media company (EBC).. Lula increased the number of federal ministries, from 23 to 37, adding billions of reais to state spending. Even the addition of a few economically liberal names to the government has not been sufficient to mitigate the negative mood. It sems major reforms are not on the cards.

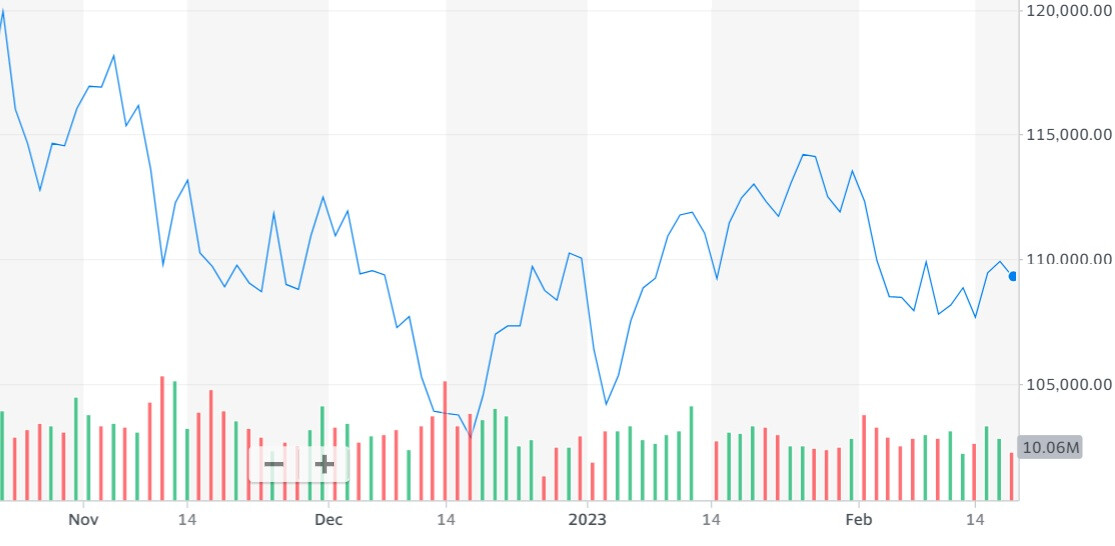

The Bovespa

The first weeks of Lula´s new government have been marked by turmoil on the Brazilian stock exchange which, at the time of writing, has lost around 7% of its value since the election, mostly on expectations of increased spending, inflation and a looming battle with the central bank on interest rates.

Volatility has spiked – especially for state-owned companies such as Petrobras and Banco do Brasil - on some of the worst weekly losses going back 30 years. For Luan Alves, chief analyst at VG Research, Lula has adopted “a belligerent tone, different from his previous two administrations when he treated the financial market more pragmatically and friendly”. Neutral stock recommendations have abounded.

And yet with strong corporate profits, Chinese economic reopening impacting on Brazil´s commodity heavy index and foreign investors eyeing bargains – forward-looking valuations are some of the lowest in 20 years – performance could improve despite the flow of likely negative macro news in the coming months. A lot could depend on the future trajectory of interest rates. Indeed, JP Morgan sees the index at 130,000 points by year end. Genial Investments is more cautious in its projections, noting that the international scenario raises concerns, but the biggest risks are domestic. In summary, Brazilian equities could remain volatile and in risk-off mode without credible fiscal policy and if controversial discourse continues.

Foreign affairs

The international scenario that Lula will now face is vastly different from 20 years ago when he first took office. We can expect greater engagement with the mostly left-wing Latin American neighbours, greater multilateralism and focus on the climate agenda. In his first international trip to Argentina, controversy ensued after the bizarre announcement of a joint regional currency. A controversial plan with a perennially bankrupt neighbour where inflation is close to 100%.

Regional neighbours will also be delighted with state development bank (BNDES) turning on the credit taps again, after the Bolsonaro government cut off such loan deals after major defaults and corruption. Lula and his PT party are famously quiet on the economic and human rights abuses in Cuba, Venezuela and Nicaragua. Indeed, the EU Ambassador to Brazil recently criticized Lula´s stance with left-wing dictators in a, since deleted, tweet. Diplomatically, Brazil is likely to remain neutral vis-à-vis the US and China, while at the same time trying to advance in trade bilaterally. A key foreign policy question mark remains over the intention to join the OECD, a Bolsonaro priority. Lula extinguished the Special Secretariat for External Relations, which coordinated work around Brazil´s entry since being granted OECD candidacy in January 2022. Celso Amorim, Lula's special advisor, had said that “there are no great benefits to joining”. Nonetheless, countries that become OECD members are seen as potentially more attractive recipients of foreign investment.

Transparency & governance

You would think that Lula, a convicted felon released on a technicality by a partisan supreme court, involved in one of the world’s largest corruption scandals only a few years ago would prioritise transparency and good governance once back in power.

And yet, of the 37 new ministers appointed by President Luiz Inácio Lula da Silva (PT), no less than 19 have been involved in legal scandals or investigations according to the Gazeta do Povo broadsheet. One new minister is already being investigated for links to organized crime. Moreover, the Council for the Control of Financial Activities (COAF), the government body responsible for combating money laundering and corruption has been transferred to the Finance ministry, from the independent Central Bank.

Another key early talking point has been the change in the State-Owned Companies Act which had prohibited currently serving politicians or political operatives from directing state-owned companies. Lula has already nominated political appointees to head up Petrobras and BNDES. This law was created in the wake of the corruption busting Lava Jato operation and considered a robust instrument to prevent political interference.

Score so far

It is early days of Lula 3.0, but for the neutral observer, the initial economic scorecard is broadly negative. Nevertheless, looking at country risk, there is definitely still appetite from foreign investors as Brazil holds a privileged position relative to other large emerging markets. But the new government's economic policy will have to reconcile a progressive agenda with fiscal responsibility without making the same past errors of interventionism, corruption and socialist populism. The warning signs are there. There have already been two impeachment protocols submitted. Or as Goldman Sachs contended: “without robust growth, Brazil may become difficult to govern”.