Latin America’s Peace Premium

A fortunate location, combined with astute foreign policy, protects the region from the geopolitical tensions enveloping the rest of the world, writes William Lee, Director at SecureValue, a business intelligence consultancy…

Latin America is often overlooked in world affairs, says William Lee from SecureValue. However, that low profile now seems like an important advantage. With the international media focussed on wars in the Middle East and Ukraine, and an increasingly assertive China, Latin America is finding itself blissfully insulated from rising geopolitical tensions.

The region’s weak economic performance since the end of the last commodities supercycle (2000-2010), pushed the region towards a second “lost decade”. Investors’ attention shifted to the emerging boom in Asia, oil-rich and business friendly Gulf states and old, safe bets in the US and Europe. Even Latin America’s sole “BRIC”, Brazil, appeared to be on the brink, as its politicians and business leaders became mired in the wide-ranging Lava Jato corruption scandal, investors got increasingly jittery about debt sustainability and deep political divisions emerged following the rise of former populist president Jair Bolsonaro.

Previously booming Andean economies, such as Peru, Colombia and Chile, saw growth stutter and faced their own political crises. And Southern Cone giant Argentina did what Argentina tends to do: lurched from one economic crisis to the next, while defaulting on its debt and printing money, stoking hyperinflation.

Peaceful part of the world

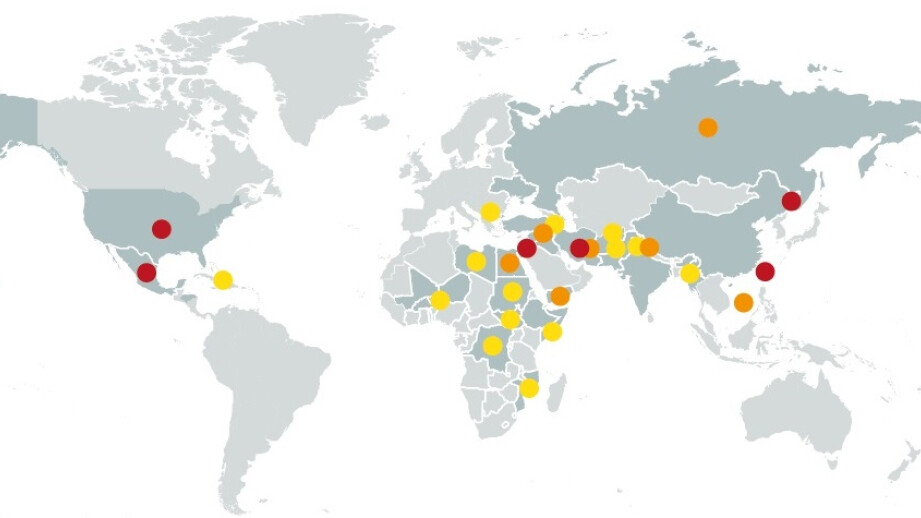

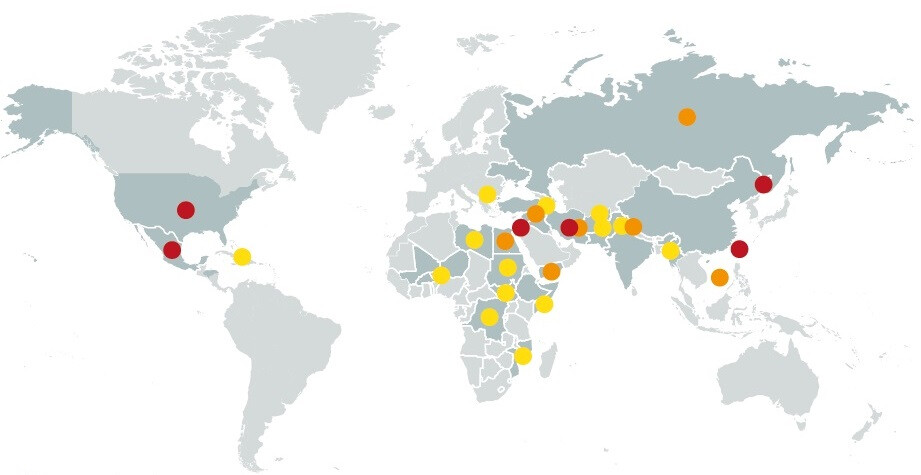

Yet with more positive, albeit not spectacular, signs starting to emerge on the economic front, Latin America suddenly finds itself well positioned in a world dogged by rising geopolitical tensions. The Middle East, after a period of relative stability, is trying to contain Israel’s conflict with Gaza from spilling over into a broader regional conflict. Europe continues to deal with the Russia-Ukraine war on its doorstep, while tensions between China and the US over Taiwan continue to escalate. These conflicts are sucking in political bandwidth and scarce financial resources. Indeed, CEOs ranked geopolitics and political uncertainty as the greatest risk to business growth in the next three years, according to a KPMG survey.

Latin America, however, is geographically removed from all these flashpoints. And its leaders have so far been successful in maintaining neutral positions. Combined with improving economies this is sparking renewed interest in Latin America among investors, often beyond the traditional demand for the region’s raw materials and commodities. Fintech has proved a particularly successful area, as the region’s large unbanked population is able to acquire easy to access bank accounts via smartphones. E-commerce, which boomed during the covid-19 pandemic, still has huge scope for expansion, as access to underserved areas outside major urban centres improves. Demand for rare earth minerals positions mining giants such as Chile and Peru to supply US and EU manufacturers as they look to decouple from China.

Governance has also been steadily improving across the region. Yes, the region’s political swings can be baffling and unpredictable in equal measure, but most countries have built solid institutions that are able to withstand political instability. In an era of renewed inflationary pressures, the region’s Central Banks were some of the few to emerge from the recent cost of living crisis with their reputations enhanced.

Drawing on their experience of hyperinflation in the 1970s and 1980s, they moved faster and with greater confidence than the US Federal Reserve and European Central Bank, meaning many are now cutting rates. This will help underpin investor confidence, as previous favourites such as China appear increasingly unpredictable. In addition to the risk of conflict, the Chinese regulatory environment has become increasingly complex for foreign firms, with some facing raids and staff arrests over the past 12 months.

Chinese chums

Of all the potential flashpoints, China presents the greatest geopolitical challenge to Latin America. The region’s economies have become increasingly reliant on China as a destination for key commodities exports. It is a huge consumer of mining and energy exports, as well as agricultural commodities such as beef and soya. A conflict with Taiwan would see Latin America come under increased pressure from the US to align itself with its northern neighbour, as was the case when the US moved to limit the use of Chinese equipment (mainly Huawei and ZTE) from the roll out of 5G technology.

The same would apply on the Chinese side. China has already put pressure on a number of Latin American markets to end their diplomatic recognition of Taiwan, resulting most recently in Honduras officially ending recognition of Taiwan in March 2023. This underscores the awkward diplomatic balancing act that Latin American markets would have to maintain.

The conflict in Ukraine has shown that this balancing act is possible. Rather than shadowing the US, Latin America has adopted a more traditional “non-aligned” position. Indeed, most Latin American nations were part of the Non-Aligned Movement, a grouping of over 100 nations that did not formerly align with any major power bloc, during the Cold War. In the Second World War, the continent was untouched by the conflict. Today, in an increasingly unstable world, Latin America is starting to look like a beacon of stability.