Political Risk to Mexican Nearshoring ahead of 2024 election

José Enrique Sevilla-Macip, Senior Research Analyst, S&P Global Market Intelligence and Pollyanna De Lima, Economics Associate Director, S&P Global Market Intelligence, crunch the latest data to see how elections will impact Latin America's largest manufacturer...

Overview

The geopolitical rivalry between the US and mainland China and the global realignment of supply chains after the COVID-19 pandemic will continue to underlie Mexico’s standing as a nearshoring destination over the next decade, especially given its proximity to the US market and competitive labour costs. Although contract risks initially increased after President Andrés Manuel López Obrador (AMLO) first took office in 2018, risk indicators have been improving for the past two years for sectors other than energy and mining.

AMLO is now welcoming new investments, a stance which is likely to continue ahead of the June 2024 elections, with the government using announcements of new investment commitments as a policy success. Moreover, the nearshoring opportunity has generated a significant shift in the AMLO administration’s tax policy. Having previously avoided granting fiscal incentives to large companies, it has now moved to encourage nearshoring through fiscal assistance in the one-year outlook.

Further improvements in the government’s attitude toward nearshoring are likely regardless of who wins the 2024 election. Contenders to succeed AMLO have all explicitly expressed their overall support for nearshoring. The ruling Movimiento Regeneración Nacional’s (MORENA) candidate Claudia Sheinbaum, currently the front-runner in all published polls, has indicated that if elected, she would favour an industrial policy that encourages companies to invest in training workers and developing local supply chains. Sheinbaum would also be likely to encourage companies to channel investments towards southern states, following AMLO’s current efforts to that end.

The main opposition candidate Xóchitl Gálvez has focused her proposals regarding nearshoring on the rapid development of renewable energy projects to supply new manufacturing facilities. By contrast with Sheinbaum, however, Gálvez favours a nearshoring process with the least state intervention possible. Irrespective of who is elected as president, regional disparities in terms of infrastructure, labour supply, security and access to energy are likely to remain in the five-year outlook.

Northern and central regions of Mexico are highly likely to continue attracting the largest share of investments versus southern states, due to their proximity to the US border, solid logistics infrastructure and a long-established manufacturing footprint. Nevertheless, firms opting for the former regions will also face significant challenges over the next decade. The main operational risks for companies settling in North and Central Mexico will be security risks associated to organised criminal activity and increasing water stress – two indicators in which southern states showcase a more positive outlook.

Nearshoring PMI® survey

A special nearshoring survey was conducted with the participation of around 350 manufacturers in Mexico constituting the S&P Global Mexico Manufacturing PMI® panel. Panellists provided valuable insights into the impact of nearshoring on their order books, their expectations for the upcoming year, and the potential challenges they anticipate. Results are available by detailed sector, region, and company workforce size.

Approximately one-fifth of survey respondents reported an improvement in total demand (both domestic and export) for their goods in the 12 months leading up to July owing to nearshoring. An even higher proportion of firms (31%) anticipate growth opportunities in the year ahead. However, Mexican manufacturers have identified various challenges and risks that may hinder their ability to fully capitalise on growth opportunities associated with nearshoring. The primary concern among businesses was the cost and availability of capital (41% of firms), followed by legal and regulatory obstacles pertaining to labour laws, intellectual property, data privacy, and taxation (34%). Security ranked third, while labour shortages were only viewed as a risk factor by one-in-ten respondents.

Among the 14 broad areas of the manufacturing industry, Textiles & Clothing emerged with the largest proportion of firms (45%) indicating sales growth over the past 12 months as a result of nearshoring. Panellists in the Coke & Petroleum and Leather & Leather Products sectors also experienced positive sales developments, with 33% and 31% respectively reporting increases. One-quarter of all companies in the Transport & Equipment sector attributed higher domestic and international sales in the past 12 months to nearshoring.

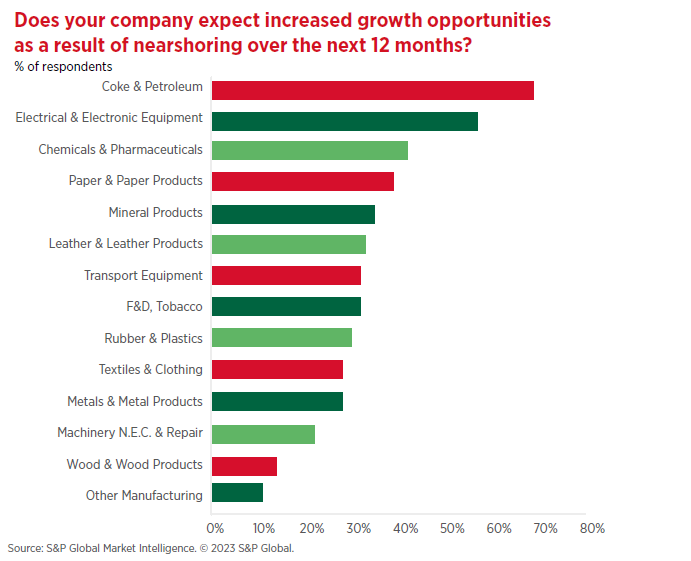

Metals & Metal Products and Rubber & Plastics ranked lowest in the ‘current demand’ sub-sector rankings. In terms of growth opportunities, the Coke & Petroleum segment had the highest proportion of companies expecting growth in the year ahead (67%). Electrical & Electronic Equipment came in second (56%), followed by Chemicals & Pharmaceuticals (39%). Transport & Equipment firms were also optimistic about growth opportunities, with exactly 30% expressing positivity.

Analysing the data by geographical regions, the Gulf Coast — which includes Nuevo León, San Luis Potosí, Tamaulipas, and Veracruz — reported the highest proportion of manufacturers experiencing demand growth due to nearshoring. Exactly 30% had already seen an upturn, and 40% anticipated opportunities over the next 12 months. The North of Mexico, covering Baja California, Baja California Sur, Chihuahua, Coahuila, Durango, Sinaloa and Sonora, had the second-best outcome, with one quarter of participants attributing sales growth in the past 12 months to nearshoring

In the West region, which encompasses Aguascalientes, Colima, Guanajuato, Guerrero, Jalisco, Michoacán, Nayarit, Oaxaca, and Zacatecas, 19% of panellists reported new order growth in the 12 months to July due to nearshoring, and 29% expected to benefit in the coming year. The East and Mexico City had the lowest proportions of companies reporting higher sales volumes due to nearshoring. Nonetheless, a significant percentage of firms in these areas anticipate growth opportunities in the year ahead. The results from the PMI survey confirm positive reports about nearshoring to Mexico.

The country’s close proximity to the US, robust logistical infrastructure, trade agreements, substantial labour force, and competitive minimum wage offer numerous advantages for firms seeking to serve the US market while mitigating supply-chain disruptions and managing costs. Indications of varying growth and expectations among different sectors, regions, and company sizes, underscore the potential benefits Mexico could reap from foreign direct investment.