The growing impact of global geopolitics on Latin America

Global sanctions enforcement and the proliferation of export controls pose spillover risks in Latin America, says Theodore Kahn, Director of Control Risks’ political, operational and security risk analysis and forecasting team…

Geopolitical tensions around the globe continue to drive an increase in the use of sanctions, export controls and other tools of economic statecraft. In the two years since Moscow’s invasion of Ukraine, the US and its allies have imposed escalating measures on individuals and entities linked to the Russian government and military, financial institutions, and companies in the energy, technology, and manufacturing sectors.

Beyond Russia, the Biden administration announced new sanctions designations against Iranian entities in response to attacks by Iran-backed militant groups in the Middle East. The result has been an unprecedented increase in the use of sanctions, with the US adding nearly 5,000 companies and individuals to the Office of Foreign Asset Control (OFAC) sanctions lists in 2022-23.

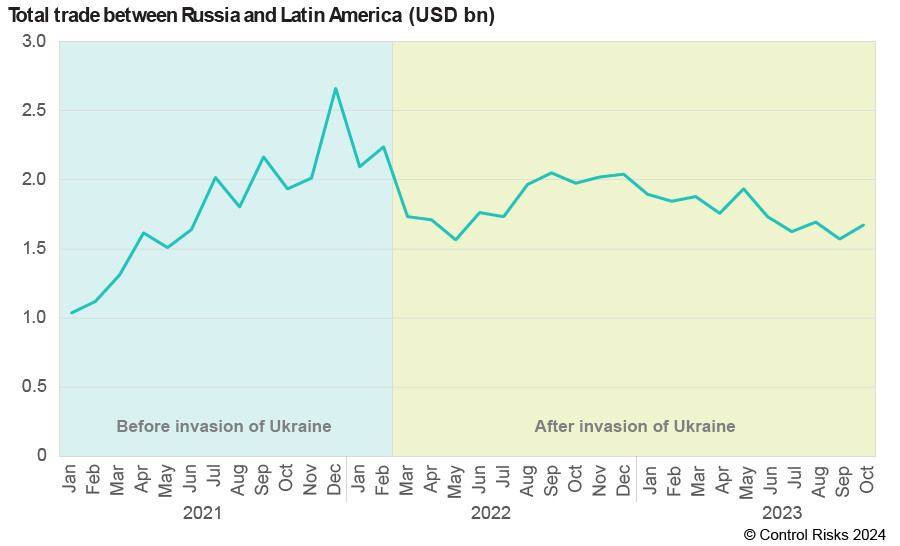

The direct impact on Latin America of the proliferation of US sanctions since 2022 has been limited given the focus on main geopolitical rivals such as Russia, China and Iran. Only one entity based in the region has been designated by OFAC under Russia sanctions programmes, and only six are listed under Iran-related sanctions. Even so, companies in the region face indirect risks due to trade ties with Russia, which have remained broadly stable despite recent geopolitical developments.

Beyond Russia, the Biden administration announced new sanctions designations against Iranian entities in response to attacks by Iran-backed militant groups in the Middle East.

Latin America’s monthly trade with Russia averaged $1.8billion between October 2022-October 2023—slightly higher than the twelve months preceding the Ukraine invasion. The region’s top exports to Russia include manufactured goods such as nuclear reactors and vehicles and their components that potentially have dual use (i.e. civilian and military) characteristics.

The US will be increasingly focused over the next year on stemming the flow of such dual-use products to individuals and entities linked to the Russian military, as discussed below. Latin American companies doing business with Russia thus face reputational damage and potential enforcement actions if their commercial partners are linked to sanctioned entities.

Crackdown on evasion

Latin America will also be impacted by a growing focus on sanctions enforcement in 2024. Over the past two years, targeted entities have used an ever-growing ecosystem of shell companies, transshipment routes, and complex transactions to evade sanctions and maintain access to restricted goods and financial assets.

In response, US and European governments are ramping up sanctions enforcement through closer coordination among regulatory entities, new policy tools (including the growing use of secondary sanctions to punish third parties that facilitate sanctions evasion), and harsher penalties. Both OFAC and the US Bureau of Industry and Security (BIS), which administers export controls, levied a record number of fines in 2023.

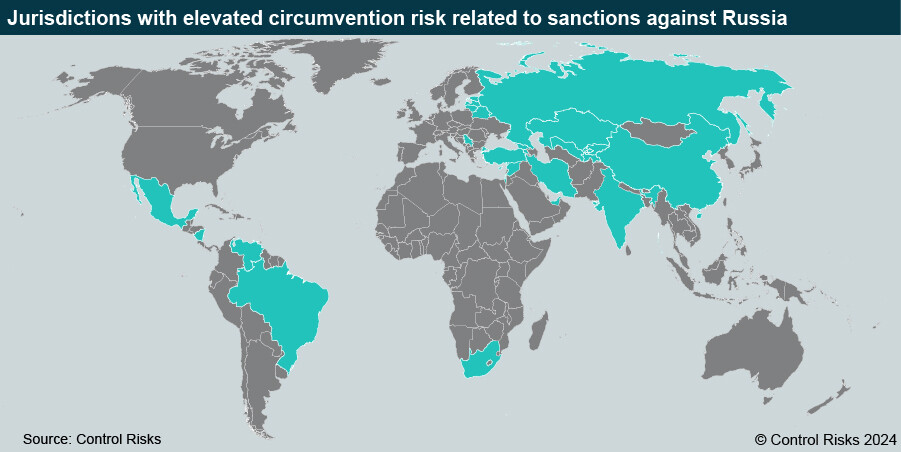

In this context, the region’s role in sanctions evasion networks will be subject to growing scrutiny. Control Risks has identified several countries in Latin America as posing elevated sanctions evasions risks (see Map).

The appearance of Nicaragua and Venezuela on this list comes as no surprise: both are heavily sanctioned and have extensive commercial and political ties to Russia. Large economies such as Brazil and Mexico, however, have been flagged by US regulatory entities as common transshipment points for restricted products whose eventual destination in Russia.

More broadly, many countries in the region are vulnerable to sanctions evasion due to the presence of key risk factors such as weak anti-money laundering (AML) controls, sophisticated organised crime groups, and illicit gold mining.

At the same time, Russian intelligence agencies have steadily deepened their presence in the region in recent years, including in countries such as Brazil, Mexico and Uruguay...

Gold plays a key role in sanctions evasion schemes due to its status as a store of value and the facility of hiding the origin and beneficiary of transactions. Since the invasion of Ukraine, for example, the US has cracked down on illicit gold dealing networks in African and the Middle East that helped facilitate transactions for sanctioned Russian entities.

Geopolitical dynamics also make Latin America fertile ground for sanctions evasion networks. Following the region’s traditional stance of non-alignment, most Latin American governments have taken an ambivalent (at best) stance to sanctions enforcement.

The presidents of Brazil and Mexico stated days after the Ukraine invasion that they would not implement sanctions against Russia. Only Costa Rica, meanwhile, has issued rules requiring businesses to comply with US restrictions against Russia. At the same time, Russian intelligence agencies have steadily deepened their presence in the region in recent years, including in countries such as Brazil, Mexico and Uruguay outside of Moscow’s traditional realm of influence. Intelligence operatives can play a key role in recruiting and coordinating sanctions evasions networks.

Export controls proliferate

Another key feature of the sanctions landscape is the rapid expansion of US export controls, which prohibit the transfer of certain products, software and technology to targeted jurisdictions and entities. These measures aim to prevent the export of dual-use goods (that is, those with potential military and civilian application) to geopolitical rivals, primarily China and Russia.

Their proliferation over the past two years means that they now cover a broad range of manufacturing goods—including many that Latin America exports in relevant quantities such as electrical equipment, nuclear reactors, plastics, and chemicals. Importantly, the export controls imposed by the US apply to foreign companies that use inputs, software, or technology that originate in the US.

The growing use of exports controls by the US (which has been mirrored by the UK and EU) carries direct and indirect implications for Latin America. First, exporters of products subject to controls will be exposed to significant fines, as well as reputational damage, if they sell to targeted entities.

The US has also applied new export controls to Latin American entities in recent months. BIS in March tightened restrictions on exports with potential military use to Nicaragua, citing concerns over the government’s security cooperation with Russia.

In addition, the proliferation of export controls on Chinese entities (and the retaliatory use of similar restrictions by Beijing) creates risks of disrupting supply chains linking companies in the region to major commercial partners. A Chinese technology firm, for example, whose access to key components is cut off by export controls, could struggle to fill orders or provide services for Latin American clients.

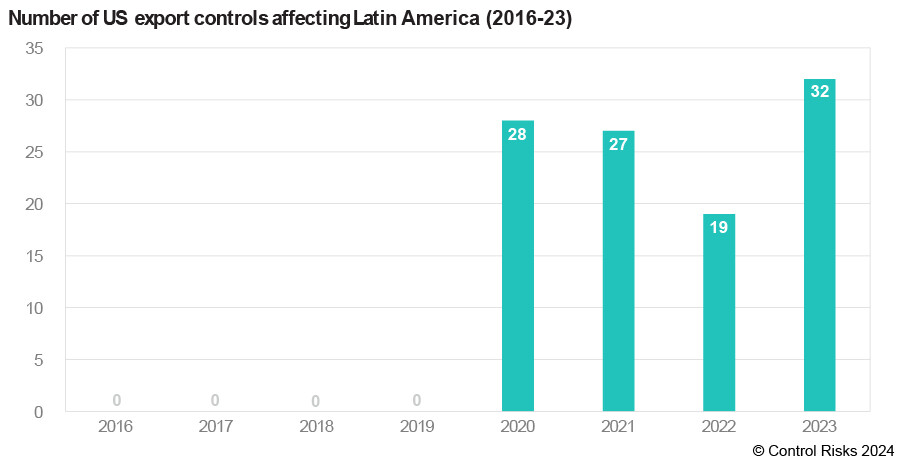

Since 2020, the US has implemented dozens of export controls affecting Latin America through this indirect channel according to data from Global Trade Alert (see Figure 3). These indirect impacts are especially relevant given the important role of Chinese companies such as Huawei (which is subject to strict US export controls) in digital infrastructure and software services in the region.

Implications for companies

The evolving sanctions landscape will present new risks for companies in Latin America as geopolitical competition between the US and its main rivals expands into new domains. While the region will not be the focus on US policy, the crackdown on sanctions evasion and expansion of export controls means that more jurisdictions, transactions, and entities will fall under the scrutiny of US enforcement agencies. This, in turn, will imply growing demands on companies’ compliance and due diligence functions, underscoring the importance of due diligence along the entire supply chain.

Understanding the ultimate beneficiaries and ownership structures of distributors and customers will be essential to assess risks related to sanctions evasion. Finally, monitoring of the rapidly-changing international sanctions regime will be increasingly important for risk management and broader strategic decision making.