Interview with Álvaro González Ricci, President of the Central Bank of Guatemala

Banguat President, Álvaro González Ricci, explains why Guatemala is well on the way to an investment grade rating...

This interview is part of our Latin American central bank special report...

LAI: What are Guatemala’s economic strengths?

Álvaro González Ricci: Guatemala has enjoyed three decades of macroeconomic stability, with an annual GDP growth of 3.5%. Like any economy we can be hit by external factors outside of our control, for example the Covid-19 pandemic caused our economy to contract by 1.8% in 2020 – the second lowest contraction in Latin America - but that was followed by 8% growth the next year, which was the highest growth in the last 40 years. In 2022 we grew by 4.1% and we are currently forecasting an annual rate of 3.5% for 2023, which is double the Latin American average. In 2024 we will likely grow at 3.5%. And that is despite being hit by higher inflation from the Ukraine conflict.

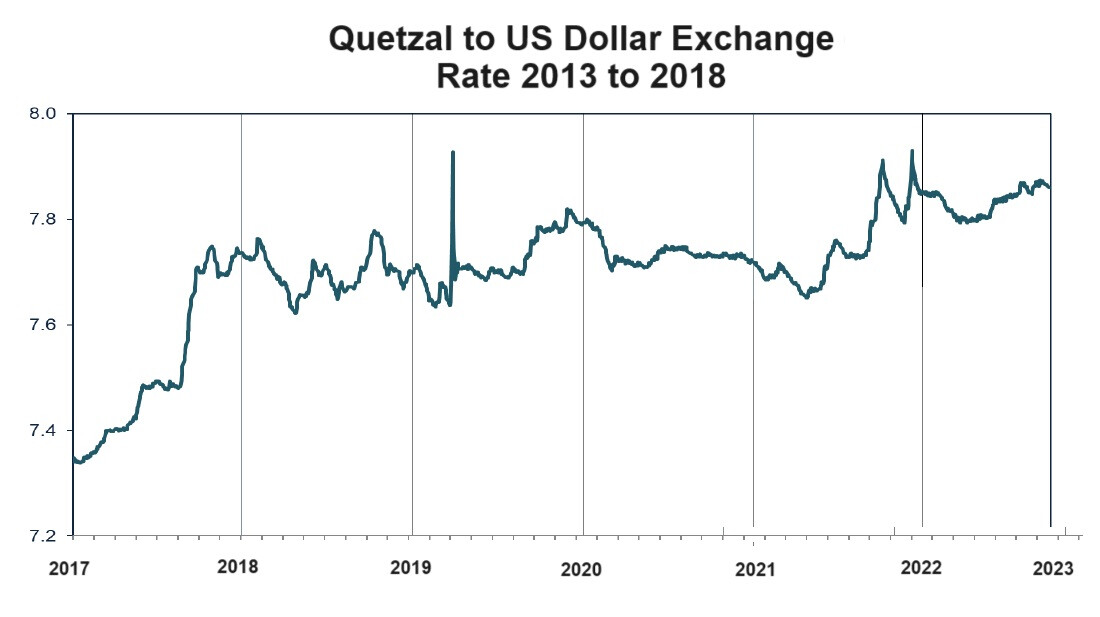

One reason for the resilience is that the bank and successive governments have followed a prudent macroeconomic policy. Moreover, while the Bank of Guatemala is independent, it works closely with the Ministry of Finance, which helps to ensure a coherent fiscal and monetary policy. This is all reflected in the exchange rate of the quetzal which has not risen or fallen by more than 1.5% against the dollar in the last ten years.

LAI: What are the weaknesses of the Guatemalan economy?

AGR: Our growth rate is good but it needs to be higher. Growing by 3.5% isn’t enough to get Guatemala to where it needs to be. One clear challenge is our infrastructure, especially our transport network, which needs to be improved for the potential growth rate of the economy to increase.

I am very positive about our economy. We have a demographic bonus, which means that our labour force is a large and growing part of our population. We also benefit from remittances sent back from overseas workers, that are worth 20% of GDP

We also need to attract higher levels of foreign direct investment. At present we attract $1.6 billion of FDI per year, which is worth around 1.5% of GDP. However, we need more local and international investment if to achieve the target of creating 2.5 million new jobs by 2030, as set out in our Guatemala No Se Detiene plan. We also need to invest more in education. Guatemala currently spends around 3.2% of GDP on education, which is well below the 6% that Costa Rica, for instance, spends. We need to improve our human talent so that our people can create value and earn a good wage.

But overall, I am very positive about our economy. We have a demographic bonus, which means that our labour force is a large and growing part of our population. We also benefit from remittances sent back from overseas workers, that are worth 20% of GDP. That is a smaller percentage than places like El Salvador, where it is 25%, but on average it’s a young remittance, which means it is being sent by recent immigrants with strong ties to the country. Around 50% of those remittances go to consumption while the other 50% is spent on construction, so it’s a steady inflow of cash that drives economic growth.

Bank credit, which is growing at double digits, is another important economic driver. Local interest rates are at record lows, which is encouraging Guatemalans of all levels to obtain credit.

LAI: Will Guatemala’s new left-wing president undermine the economy with excessive state spending?

AGR: The president-elect has an important social agenda, which he made clear during the campaign. I’ve met the president-elect and believe he recognises that key elements – such as central bank independence and the low fiscal deficit – have given Guatemala its macroeconomic stability.

I think the new president will focus on fighting corruption, improving the state’s provision of education and health and making public spending more efficient. Having a solid macroeconomy will actually help him achieve his aims because economic growth generates higher tax returns. In 2022 the tax take reached a record $12.5billion, up from $7.8billion in 2020, and that money can be used to fund social programmes.

LAI: Latin American central banks did a better job at controlling inflation than their G7 peers; why?

AGR: I don’t want to allude to other central banks, but I think it is clear that the Federal Reserve acted late in increasing its policy rate. The trouble is that when you delay fighting inflation you then have to take more aggressive steps when you eventually do decide to act. I guess the US was used to an era of zero interest rates and low inflation. Officially the Fed’s target inflation rate is 2% but maybe it needs to increase that because the real inflation rate is well above that at the moment. The US economy is very resilient with strong consumption and employment but the unfortunate fact is that when you want to lower inflation you need to slow down an economy and create unemployment.

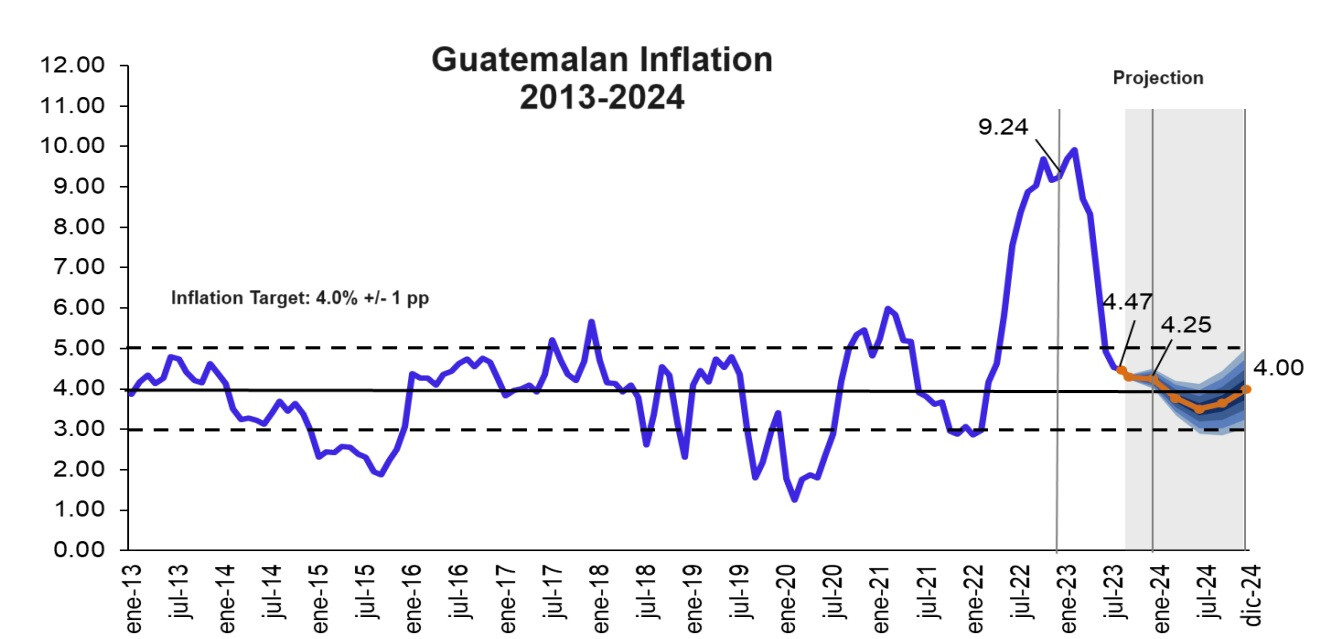

In Guatemala we began to raise rates as soon as inflation arrived. However, the increases were very gradual, so that the GDP growth rate wasn’t too badly affected. We managed to impact inflation expectations because people saw that we would act on inflation straight away. The credibility of the Bank of Guatemala meant that local businesses didn’t worry that inflation would get out of control.

If you look across the region, you see that most Latin American banks worked quickly. Some of these countries have experienced hyperinflation, so they knew to move swiftly against inflation. However, some central banks had to take the policy rate very high. Costa Rica got to 8%, while Brazil, Colombia and Mexico all saw their benchmark rates go into double digits. That isn’t ideal for economic growth. In Guatemala we went from a record low of 1.75% during the pandemic, to the current level of 5%, which is a much smaller swing than in other countries in the region. We did that because we wanted to protect economic growth. I believe we were successful, now inflation is on target.

LAI: The Bank of Guatemala’s dollar reserves are at record highs; how will you manage them?

AGR: We have more than $20billion of reserves in dollars, which can cover eight months of the country’s export needs – far higher than the three months cover it is recommended to have. That has given Guatemala credibility in the eyes of international investors because they know we can handle the dollar requirements of any external shock. The reserves are actually earning good returns at the moment because of the interest rates in the US. It is also helping us save money on our own financing. For example, the government recently issued a Eurobond that got similar rates to investment grade countries. Another advantage is that the reserves help secure the stability of the quetzal.

The accumulation of dollar reserves is caused by a surplus in the balance of payments current account, which is being driven by high remittances. We don’t have a specific target for our dollar reserves but we are relaxed because we expect the current account to be balanced by 2025.

LAI: Does the Bank of Guatemala control the exchange rate?

AGR: The market is free but the bank participates to help moderate the volatility. The quetzal is a relatively small exchange market, which is dominated by remittances. Two local banks handle 85% of the remittance business, so if one of those banks decides it wants to accumulate remittances, then we will have a lack of dollars in the market. So, the central bank holds five auctions per day, with a maximum total value of $100million. If any bank has a need to buy or sell a large amount of dollars, they can use our auctions without impacting the wider market. But our participation is worth less than 1% of the total market.

The IMF would like us to stop participating in the market but we don’t want to have a volatile exchange rate. We’ve found that the rate can shoot up in one day but take a month to fall. We can’t have volatility because there is no futures market for Guatemalan companies to fix the value of the quetzal, so we need to ensure that it remains stable.

LAI: How does the Bank of Guatemala work with international financial entities?

AGR: As a Central Bank we work with international entities to improve the technical capacity of our human talent. We are open to working with central banks when it comes to technical operations and investing the reserves. With the private banks, there are multiple commercial relations with international banks. A loan in quetzales is cheaper than in dollars at the moment so local banks are cancelling their dollar credit lines. Dollar-denominated loans used to be 20% cheaper than in quetzales but that is no longer the case.

Guatemala has many credit lines with multilateral banks. Recently we decided to use one of our flexible credit lines with the World Bank to get a lower rate than we would have by placing bonds. The way we explain it to the general public is that it’s like taking out a loan with the bank instead of the credit card.

LAI: When will Guatemala become investment grade?

AGR: Last year the three main ratings agencies – Fitch, Moody’s and S&P, improved their perspectives of Guatemala. We were probably the only country that saw its rating improve in the wake of the pandemic. This year Fitch and S&P increased our rating to BB Stable, which is just two notches from investment grade. Moody’s will review its Guatemala rating next year and I expect another improvement. But we have to be patient and prove to these agencies that we belong at investment grade. They won’t move us up to investment grade unless they are sure that we are ready to stay there, so I think it might take a few years to demonstrate that. There will probably be some political uncertainty until the president-elect takes office and defines his economic plan. But I am certain we will get to investment grade.

LAI: What’s your vision of Guatemala’s economy in 2030?

AGR: Guatemala’s natural resources haven’t been exploited in a responsible way. You look at the likes of Colombia and Chile and they have derived great wealth from commodities but we haven’t done that yet. We have a great position, in the centre of the Americas, but we need to strengthen our roads and ports to make the most of it. Our young and growing population is another strength.

We are seeing positive developments of leading manufacturers from Asia coming to Guatemala because our competitive cost structure and location offers them a great way to integrate with North American supply chains. But there is lots more to do. We already have the roadmap – Guatemala no se detiene – and now we just need to follow it.